Blog Information

- Posted By : Medicare Nationwide

- Posted On : Apr 29, 2024

- Views : 48

- Category : General

- Description : Welcome to the world of Medicare Supplement Plans, where peace of mind meets comprehensive coverage. In the vast landscape of healthcare, navigating your options can feel like a daunting task.

Overview

- Welcome to the world of Medicare Supplement Plans, where peace of mind meets comprehensive coverage. In the vast landscape of healthcare, navigating your options can feel like a daunting task. But fear not! Today, we embark on a journey to unravel the mysteries of Medicare Supplement Plan M, your ticket to enhanced healthcare coverage.

What Is Medicare Supplement Plan M?

Imagine this: You have Medicare, but it's like having a slice of cake without the frosting. That's where Medicare Supplement Plan M swoops in like the hero of your healthcare story. It's like the icing on the cake, filling in the gaps left by original Medicare and giving you a smoother ride through the healthcare system.

How Does Medicare Supplement Plan M Work?

Think of Medicare Supplement Plan M as your trusty sidekick, working hand in hand with your original Medicare coverage. When you incur medical expenses, Medicare pays its share, and then Medicare Supplement Plan M steps up to bat, covering the rest. It's a dynamic duo, ensuring that you're not left high and dry when it comes to healthcare costs.

What Does Medicare Supplement Plan M Cover?

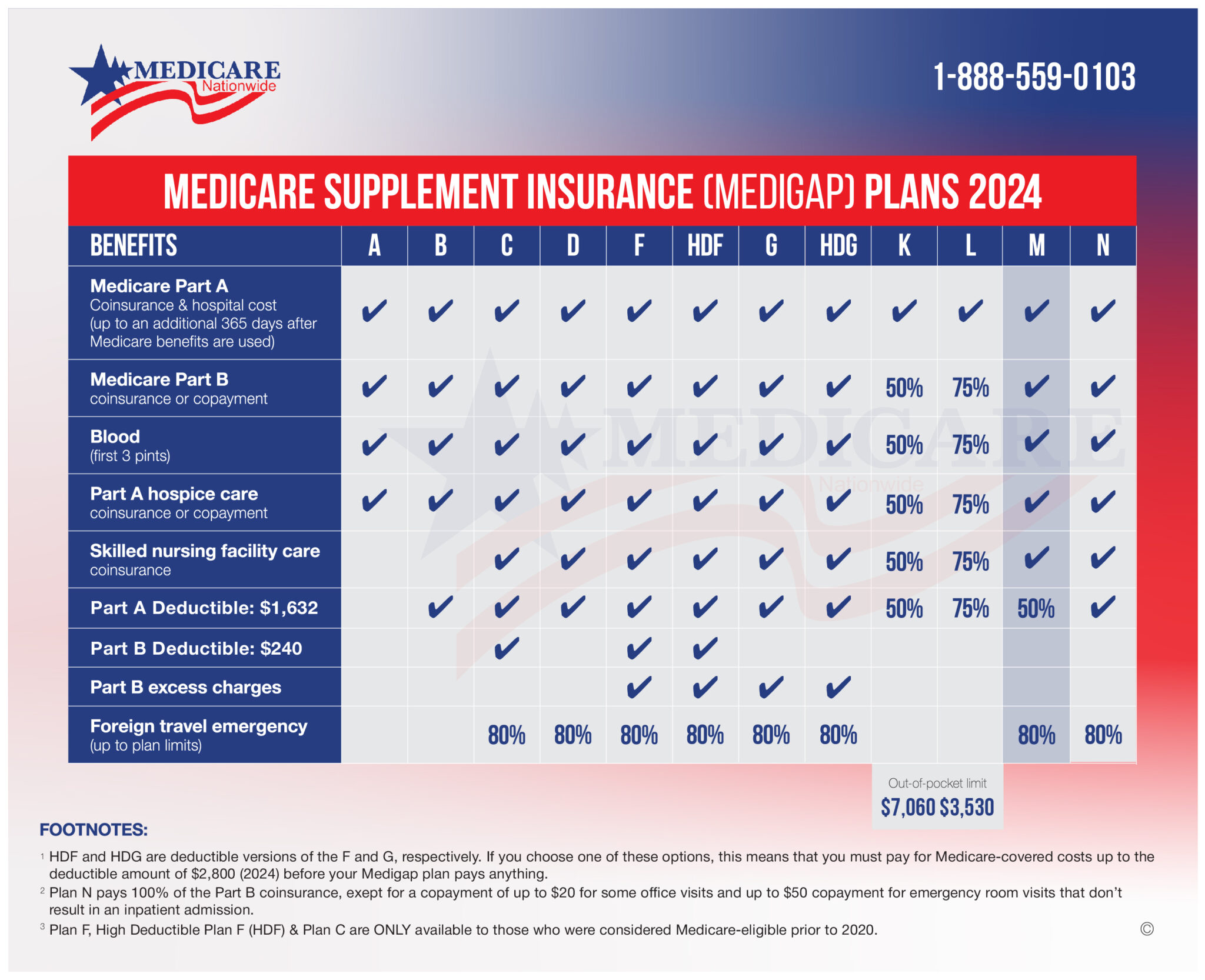

Now, let's talk about the goodies that come with Medicare Supplement Plan M. It's like unwrapping a present filled with valuable healthcare benefits:

1. Medicare Supplement Part A Coinsurance and Hospital Costs: Medicare Supplement Plan M has your back when it comes to those pesky hospital bills and skilled nursing facility costs that Medicare alone may not fully cover.

2. Medicare Supplement Part B Coinsurance or Copayment: Say goodbye to worrying about the cost of doctor's visits and outpatient services. Plan M helps foot the bill once you've cleared your yearly deductible.3. Blood (First 3 Pints): Need blood for a medical procedure? Medicare Supplement Plan M says, "Don't worry, we've got you covered," for the first three pints.4. Hospice Care Coinsurance or Copayment: During challenging times, Medicare Supplement Plan M provides support by helping cover the coinsurance or copayment for hospice care.But remember, while Medicare Supplement Plan M offers robust coverage, it's not a catch-all solution. It won't cover long-term care, dental care, vision care, hearing aids, or private-duty nursing.Is Medicare Supplement Plan M Right for You?

Imagine standing at a crossroads, trying to decide which path to take. Choosing whether Medicare Supplement Plan M is right for you is a bit like that. Here are some signposts to help guide your decision:1. Your Health Needs: If you find yourself frequenting the doctor's office or needing medical services often, Medicare Supplement Plan M can be a lifesaver, reducing your out-of-pocket expenses.2. Your Budget: Let's talk dollars and cents. Compare the monthly premiums, deductibles, and other healthcare costs associated with Plan M to see if it aligns with your budgetary goals.3. Your Coverage Preferences: Consider what matters most to you in terms of healthcare coverage. If Medicare Supplement Plan M checks off the boxes for your needs, it might be the perfect fit.4. Your Future Healthcare Needs: Peering into the crystal ball of your health future, think about any upcoming medical procedures or conditions that may require additional coverage. Medicare Supplement Plan M can provide that extra layer of financial protection.

How to Enroll in Medicare Supplement Plan M?

Ready to take the plunge into Medicare Supplement Plan M territory? Here's your roadmap for enrollment:1. Be Enrolled in Medicare Part A and Part B: To hop aboard the Medicare Supplement Plan M train, you'll need to have both Medicare Part A and Part B.2. Shop Around: Explore different insurance companies offering Medicare Supplement Plan M in your area. It's like shopping for the perfect outfit – compare costs, coverage, and customer reviews to find your ideal match.3. Apply During Open Enrollment: Timing is everything. Enroll during your open enrollment period, which kicks off when you're 65 or older and enrolled in Medicare Part B. This gives you guaranteed issue rights, meaning no denials or inflated premiums due to pre-existing conditions.4. Complete the Application: Once you've found your perfect Medicare Nationwide Medicare Supplement Plan M match, fill out the application with accurate information to ensure a smooth process.5. Review and Confirm: Before sealing the deal, carefully review your policy documents to understand the terms, coverage, and costs associated with Plan M.6. Pay Your Premiums: Once approved, start paying your monthly premiums to keep your Plan M coverage sailing smoothly.Conclusion

Medicare Supplement Plan M isn't just another insurance option – it's your partner in healthcare, providing peace of mind and comprehensive coverage. Armed with knowledge about how Medicare Supplement Plan M works, what it covers, and how to enroll, you're equipped to make an informed decision about your healthcare future. So, go forth with confidence, knowing that Medicare Supplement Plan M has your back every step of the way.