Reverse Mortgage Solutions: Enhancing Lead Generation and Growth

الجسم

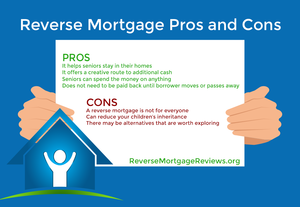

Reverse mortgage solutions offer a valuable financial tool for seniors, allowing them to tap into their home equity to supplement their retirement income. However, the effectiveness of these solutions hinges significantly on the technology and strategies employed by mortgage professionals. This is where purpose-built mortgage software comes into play. At Reverse Focus, we understand the need for innovative tools that not only streamline the reverse mortgage process but also enhance lead generation and relationship management.

The Power of Purpose-Built Mortgage Software

Reverse mortgage professionals face a unique set of challenges, including generating quality leads and managing client relationships effectively. Traditional methods may no longer suffice in the fast-paced, technology-driven environment of today. Purpose-built mortgage software addresses these needs by offering a range of features designed to optimize performance and foster growth.

Improving Lead Generation

One of the primary functions of specialized mortgage software is to enhance lead generation. In the competitive world of reverse mortgages, acquiring quality leads is crucial. Our software solutions provide advanced tools for identifying and targeting potential clients more effectively. By utilizing data analytics and customer insights, you can pinpoint individuals who are most likely to benefit from a reverse mortgage, thereby increasing the efficiency of your marketing efforts.

Enhancing Relationship Management

Managing relationships with clients and prospects is another critical aspect of the reverse mortgage business. Purpose-built software offers features that streamline communication and ensure that no opportunity is missed. From automated follow-ups to personalized communication, these tools help maintain and strengthen client relationships. This not only improves client satisfaction but also increases the likelihood of referrals and repeat business.

Strategic Path for Growth

Growth in the reverse mortgage industry requires a strategic approach. Our software provides a clear path for expansion by offering detailed performance metrics and growth projections. By analyzing key data points, you can make informed decisions about where to focus your efforts and how to allocate resources most effectively. This strategic insight is essential for scaling your business and staying ahead of the competition.

Integration and User Experience

A significant advantage of purpose-built software is its ability to integrate seamlessly with other systems and platforms. Whether you’re using CRM systems, marketing automation tools, or financial planning software, our solutions are designed to work harmoniously with your existing technology stack. This integration ensures a smooth user experience and minimizes the risk of data silos.

Customization for Your Needs

Every reverse mortgage business is unique, and one-size-fits-all solutions rarely address specific needs. Our software offers customization options that allow you to tailor the system to your particular requirements. From custom reporting to specialized workflows, you can configure the software to match your business processes and objectives.

Conclusion

Reverse mortgage solutions are a powerful financial tool for seniors, but their success relies on the effectiveness of the technology and strategies used by mortgage professionals. Purpose-built mortgage software from Reverse Focus enhances lead generation, improves relationship management, and provides a strategic path for growth. By leveraging advanced tools and data-driven insights, you can optimize your operations and achieve greater success in the reverse mortgage industry. Investing in the right software is a crucial step toward driving growth and delivering exceptional service to your clients.

تعليقات