Understanding Cold Wallets: The Essential Guide for Cryptocurrency Investors

Cuerpo

In the world of cryptocurrency, securing your digital assets is paramount. One of the most effective ways to achieve this is through a cold wallet. But what exactly is a cold wallet, and why should you consider using one? This guide will delve into the intricacies of cold wallets, their benefits, and how they compare to other storage options.

What is a Cold Wallet?

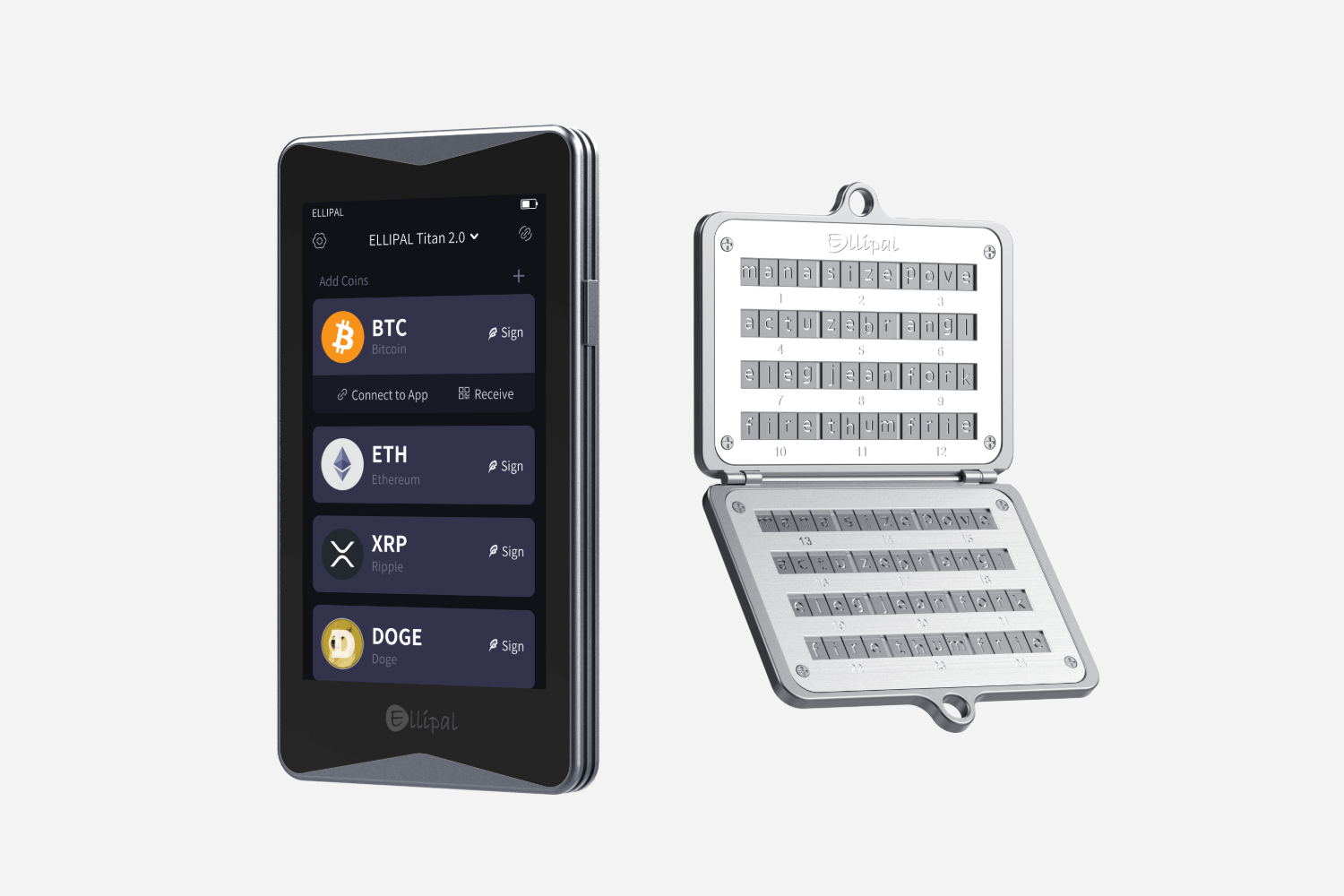

A cold wallet refers to a type of cryptocurrency wallet that is not connected to the internet. This offline storage method significantly reduces the risk of hacking and unauthorized access. Cold wallets can take various forms, including hardware wallets, paper wallets, and even physical devices designed specifically for cryptocurrency storage.

Types of Cold Wallets

- Hardware Wallets: These are physical devices that securely store your private keys offline. Popular options include the Ledger Nano and Trezor.

- Paper Wallets: This method involves printing your private keys and public addresses on paper, which can be stored securely.

- Air-Gapped Devices: These are computers or devices that have never been connected to the internet, ensuring maximum security.

Benefits of Using a Cold Wallet

Investors often wonder why they should opt for a cold wallet over a hot wallet, which is connected to the internet. Here are several compelling reasons:

- Enhanced Security: Since cold wallets are offline, they are less susceptible to cyber attacks.

- Long-Term Storage: Cold wallets are ideal for investors looking to hold their cryptocurrencies for an extended period without frequent transactions.

- Control Over Assets: Users maintain full control over their private keys, reducing reliance on third-party services.

Choosing the Right Cold Wallet

When selecting a cold wallet, consider the following factors:

- Security Features: Look for wallets that offer robust security measures, such as two-factor authentication and encryption.

- User Experience: Choose a wallet that is easy to use and understand, especially if you are new to cryptocurrency.

- Compatibility: Ensure that the wallet supports the cryptocurrencies you intend to store.

For those seeking a reliable hardware wallet, the is an excellent choice. It combines security with user-friendly features, making it suitable for both beginners and experienced investors.

Conclusion

In conclusion, understanding the role of a cold wallet is crucial for anyone serious about cryptocurrency investment. By opting for a cold wallet, you can enhance the security of your digital assets and maintain control over your investments. Whether you choose a hardware wallet, paper wallet, or another form of cold storage, the key is to prioritize security and usability. As the cryptocurrency landscape continues to evolve, staying informed about your storage options will empower you to make the best decisions for your financial future.

Comentarios