- الكلمات - #BLOG

-

- آخر تحديث ١٤ نوفمبر، ٢٠٢٤ تعليق ٠ , ١٥٠ views, ٠ مثل

More in Politics

Related Blogs

أرشيف

Understanding Cold Wallets: A Comprehensive Guide for Cryptocurrency Investors

الجسم

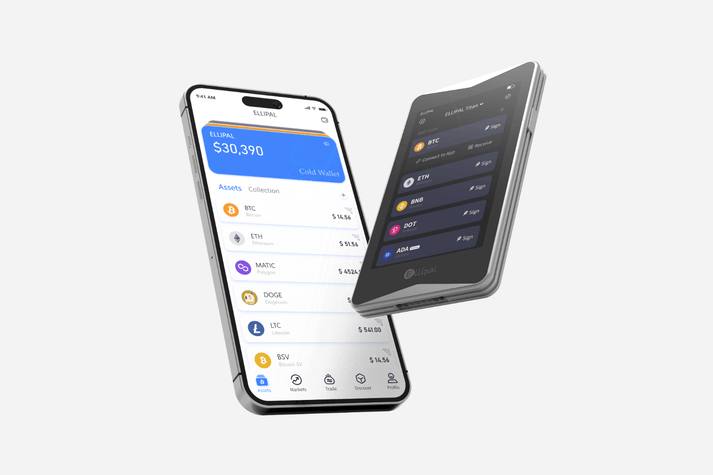

In the rapidly evolving world of cryptocurrency, securing your digital assets is paramount. One of the most effective methods for safeguarding your investments is through the use of a cold wallet. This article aims to provide a thorough understanding of cold wallets, their types, and best practices for cryptocurrency investors.

What is a Cold Wallet?

A cold wallet refers to a type of cryptocurrency wallet that is not connected to the internet. This disconnection from online networks significantly reduces the risk of hacking and unauthorized access. Unlike hot wallets, which are always online and more convenient for frequent transactions, cold wallets prioritize security over accessibility.

Types of Cold Wallets

There are several types of cold wallets available, each with its unique features and benefits. Understanding these can help you choose the right option for your needs:

- Hardware Wallets: These are physical devices designed specifically for storing cryptocurrencies securely. They often come with advanced security features, such as PIN protection and recovery seed phrases.

- Paper Wallets: A paper wallet is a physical printout of your public and private keys. While it is highly secure from online threats, it can be easily lost or damaged.

- Air-Gapped Wallets: These wallets operate on devices that have never been connected to the internet. They are considered extremely secure but can be less user-friendly.

Why Use a Cold Wallet?

Investors often wonder, "Why should I use a cold wallet?" The answer lies in the enhanced security it offers. By keeping your private keys offline, you mitigate the risks associated with online threats such as phishing attacks and malware. Additionally, cold wallets are ideal for long-term storage of cryptocurrencies, making them a preferred choice for serious investors.

Best Practices for Using Cold Wallets

To maximize the security of your cold wallet, consider the following best practices:

- Always keep your recovery seed phrase in a secure location.

- Regularly update the firmware of your hardware wallet.

- Use strong, unique passwords for your wallet accounts.

- Consider using a reputable hardware wallet, such as the

, which offers robust security features.

Conclusion

In conclusion, a cold wallet is an essential tool for cryptocurrency investors who prioritize security. By understanding the types of cold wallets available and implementing best practices, you can significantly reduce the risk of losing your digital assets. As the cryptocurrency landscape continues to evolve, staying informed and adopting secure storage methods will be crucial for protecting your investments.

تعليقات