GenAI Use Case Deep Dive: Transforming Claims Processing Workflows

Body

Think of conventional claims processing like a traffic jam: each claim is a car inching along, stuck behind layers of manual steps and red tape. Now, imagine a freeway with traffic flowing smoothly and cars moving at lightning speed. That’s the difference genai use case makes. With machine learning and large language models (LLMs), insurers can now quickly analyze, prioritize, and process claims with an unprecedented level of speed and accuracy.

From the moment a claim is submitted, AI-powered systems can handle vast amounts of both structured and unstructured data—summarizing detailed reports and helping adjusters make faster, more informed decisions. This isn’t just about automating routine tasks—it’s about enhancing human expertise. genai use case acts as a powerful assistant, making sure claims are resolved efficiently and precisely.

The results are clear. AI-driven claims automation is transforming the entire process, from the First Notice of Loss (FNOL) all the way to final settlement. Today’s AI-enabled call centers can handle up to 90% of claims without human input, cutting both resolution times and operational costs. As more insurers adopt these technologies, the entire industry is evolving—becoming more agile and more focused on the customer experience.

The Role of Neural Networks in Generative AI for Claims

To fully appreciate how genai use case is changing claims processing, it's helpful to understand the technology behind it. At the core are neural networks—systems modeled after how the human brain works. Picture them as a complex network of roads, where data moves through intersections (called nodes), learning from past patterns and even building new paths as it encounters new challenges.

Thanks to these neural networks, generative AI doesn’t just repeat what it’s learned—it can generate new, useful insights by processing huge volumes of information. When asked a question, a large language model doesn’t just pull data from one place—it synthesizes knowledge from countless sources to produce a clear, relevant answer.

While traditional AI has played a valuable role in analyzing claims data, spotting trends, and assessing risk—such as predicting claim costs or interpreting sensor data—generative AI goes further. It can also make sense of unstructured inputs like handwritten notes, customer emails, or photos from an accident scene. By transforming this messy, complex data into structured insights, it helps insurers handle claims more effectively.

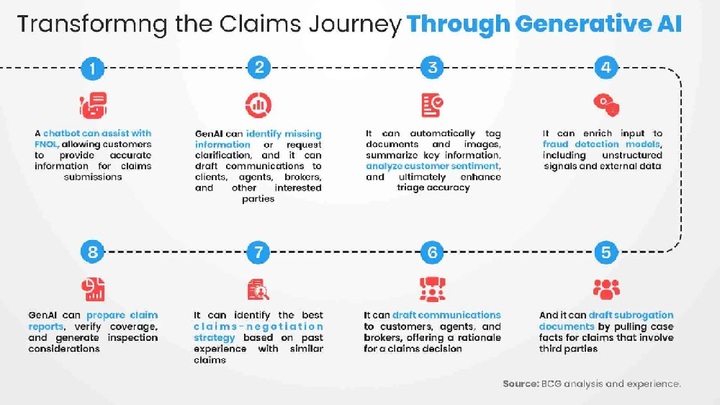

How Generative AI is Reshaping the Claims Lifecycle

Claims processing is one of the most critical aspects of insurance—it involves not only significant payouts and manpower, but it also shapes customer experience and loyalty. That’s why many insurers are turning to generative AI: to reduce costs while making claims resolution faster and smoother.

At the heart of the process is the ability to rapidly analyze large volumes of data, from policy information to detailed incident reports, and assess the legitimacy of a claim. Generative AI can instantly evaluate this information, drawing on past cases and trends to make intelligent decisions.

A standout example is Lemonade, a U.S.-based insurtech company that has reimagined claims processing through AI. Their AI bot, AI Jim, can process claims in seconds—identifying potential fraud, evaluating customer input, and authorizing payments almost instantly. AI Jim extracts key data from customer statements, compares it with policy terms, and determines payouts with minimal human involvement. For more complex cases, the system routes claims to human adjusters, ensuring a balance between speed and thoughtful review.

The result? Dramatically faster claims handling, improved accuracy, and a better experience for customers.

Comments