How to Start CFD Trading in an Efficient Way?

Body

Contracts for Difference, or CFDs, are a type of derivative that facilitates leveraged financial trading online. It is a legally binding agreement to trade the price difference between two specified financial instruments between the opening and closing of trading. CFD Spot Energy allow you to trade in a wide variety of financial assets, including stocks, commodities, options, currency pairs, and more.

Choosing reliable Best Cfd Traders is the initial step in getting started. Choosing a service provider with a proven track record of accomplishment in the industry is essential. Checking out their website to see what kinds of amenities and services they provide their customers with. Consider the fee rates & spreads they offer for the marketplaces you are interested in trading in.

Trading contracts for difference (CFDs) online is a versatile technique to form opinions on various financial assets. The risk management strategy that can prevent losses and reduce the likelihood of losing money is something you will learn about in CFD training.

The online application processes of the most popular Energy Trading Companies are quick and painless. Getting started is as simple as going to the websites and following the outlined steps. You should be able to choose from multiple account types at the Trade Forex CFD provider you choose. Do some research to find the one that best accommodates your trading needs and risk management constraints.

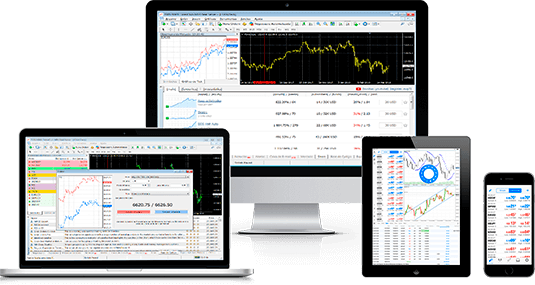

You will be given access information to your CFD account after it has been set up. Your new CFD account will require a cash deposit. Taking a CFD position in a financial instrument is as simple as selecting the instrument of your choice. Here are the few most crucial factors to keep in mind: You should prioritize your own trading needs over the provider's convenience when selecting a trading service and platform. Guaranteed stops are an essential part of their suite of risk management techniques. The best CFD brokers of MT4 Trading Platform offer access to a wide variety of markets, comprehensive educational programs, and a wealth of tools for analyzing those markets.

Having a test account prior to launching your real one is a necessary. Understanding the financial repercussions of poor trading is essential. Because CFDs are leveraged financial instruments, it is possible to lose more than your initial investment. It is possible that not all types of financial traders are suited to this type of trading. Before making a final decision, it is crucial to gain a thorough understanding of CFDs from every angle.

You can Metatrader 4 Free Download as this system may have many different types of rules, such as entry triggers, loss limits, profit take-profit targets, and loss trailing. Resistance and support lines, chart patterns, and congestion zones are all examples of rules and triggers that, if not understood, could lead to trades with a poor probability of success. As you notice, there are several prerequisites before trading CFDs on stocks, commodities, or indices with Forex Mt4 Download. Take them into account, and make it a point to learn as much as you can about trading.

Comments