Discover the Benefits of Using an E Money App for Everyday Transactions

Cuerpo

In recent years, the landscape of financial transactions has undergone a significant transformation with the advent of E Money apps. These digital platforms have revolutionized the way individuals and businesses manage their money, offering convenience, security, and efficiency like never before. Here's a comprehensive look at the benefits of using an E Money app for everyday transactions:

1. Convenience at Your Fingertips

E Money apps simplify the process of financial transactions by allowing users to send and receive money instantly, anytime, and anywhere. Whether you're splitting a bill at a restaurant, paying for groceries, or transferring funds to a friend or family member, all it takes is a few taps on your smartphone.

2. Security Measures

One of the primary concerns with digital transactions is security. E Money apps address this with robust security features such as encryption, two-factor authentication, and biometric verification (like fingerprint or facial recognition). These measures ensure that your financial information remains secure and protected from unauthorized access.

3. Track and Manage Expenses

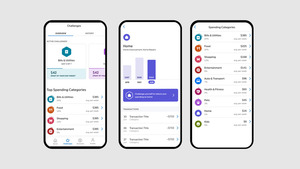

Tracking expenses becomes effortless with E Money apps. Most apps provide detailed transaction histories and categorize expenditures, giving users insights into their spending patterns. This feature is invaluable for budgeting and financial planning.

4. Accessibility and Inclusivity

E Money apps have democratized access to financial services. They are accessible to anyone with a smartphone and internet connectivity, bridging the gap for those who may not have easy access to traditional banking services. This inclusivity is crucial for financial empowerment and economic participation.

5. Promotions and Rewards

Many E Money apps offer incentives such as cashback, discounts, or reward points for using their services. These promotions not only make transactions more cost-effective but also enhance the overall user experience.

6. Faster and More Efficient Transactions

Gone are the days of waiting in line at banks or dealing with the delays associated with traditional payment methods. E Money apps facilitate near-instantaneous transactions, reducing the time spent on financial chores and enabling users to focus on more productive activities.

7. Environmentally Friendly

Using E Money apps reduces reliance on physical currency and paper receipts, contributing to environmental sustainability. By opting for digital transactions, users can play a part in minimizing their carbon footprint.

Conclusion

E Money apps have transformed everyday transactions, offering unparalleled convenience, security, and efficiency. Whether you're making a small purchase or managing business expenses, these digital platforms streamline financial interactions in ways that traditional methods cannot match.

In conclusion, embracing E Money apps not only simplifies your financial life but also aligns with the evolving digital economy. As technology continues to advance, these apps are likely to play an increasingly pivotal role in shaping how we manage and interact with money.

Comentarios