The Ultimate Guide to Cold Wallets: How to Secure Your Cryptocurrency Investments

Body

In the ever-evolving world of cryptocurrency, securing your digital assets is paramount. One of the most effective methods to achieve this is through the use of a cold wallet crypto. But what exactly is a cold wallet, and how does it differ from other types of wallets? This guide will provide you with a comprehensive understanding of cold wallets, their benefits, and how to choose the right one for your needs.

What is a Cold Wallet Crypto?

A cold wallet crypto refers to a type of cryptocurrency wallet that is not connected to the internet. This offline storage method significantly reduces the risk of hacking and unauthorized access. Cold wallets can take various forms, including hardware wallets, paper wallets, and even physical devices like USB drives. By keeping your private keys offline, you enhance the security of your digital assets.

Benefits of Using a Cold Wallet

There are several advantages to using a cold wallet for your cryptocurrency investments:

- Enhanced Security: Since cold wallets are offline, they are less susceptible to cyber attacks.

- Control Over Assets: Users maintain full control of their private keys, reducing reliance on third-party services.

- Long-Term Storage: Cold wallets are ideal for holding cryptocurrencies for extended periods without the need for frequent access.

- Protection Against Malware: By being disconnected from the internet, cold wallets are immune to malware that targets online wallets.

Choosing the Right Cold Wallet Crypto

When selecting a cold wallet, consider the following factors:

- Type of Wallet: Decide between hardware wallets, paper wallets, or other forms of cold storage.

- Security Features: Look for wallets with strong encryption and backup options.

- User Experience: Choose a wallet that is easy to use and understand, especially if you are new to cryptocurrency.

- Reputation: Research the manufacturer and read reviews to ensure reliability.

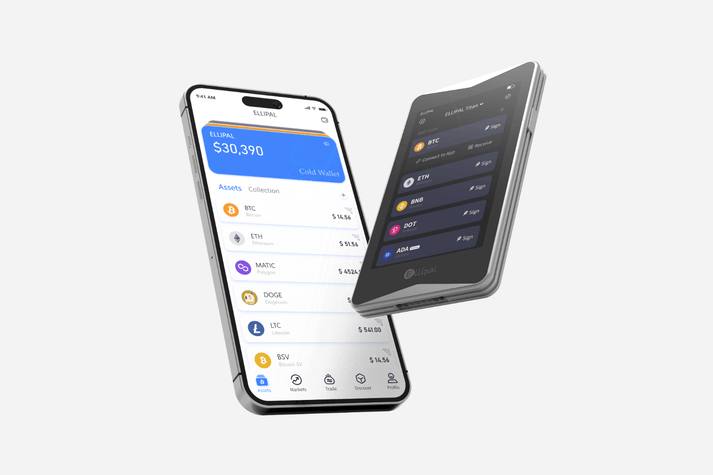

One highly recommended option is the  . This hardware wallet offers robust security features and user-friendly design, making it an excellent choice for both beginners and experienced investors.

. This hardware wallet offers robust security features and user-friendly design, making it an excellent choice for both beginners and experienced investors.

Best Practices for Using a Cold Wallet

To maximize the security of your cold wallet crypto, follow these best practices:

- Regular Backups: Ensure that you regularly back up your wallet and store the backup in a secure location.

- Keep Software Updated: If your cold wallet has firmware, keep it updated to protect against vulnerabilities.

- Use Strong Passwords: Always use complex passwords and enable two-factor authentication when possible.

Conclusion

In conclusion, a cold wallet crypto is an essential tool for anyone serious about securing their cryptocurrency investments. By understanding the benefits, choosing the right wallet, and following best practices, you can protect your digital assets from potential threats. As the cryptocurrency landscape continues to grow, investing in a cold wallet is a proactive step towards safeguarding your financial future.

Comments