Unlock the Secrets to the Best Cold Wallets for Your Cryptocurrency!

As the cryptocurrency market continues to gain momentum, ensuring the security of your digital assets has never been more critical. With the surge in popularity of cryptocurrencies, the risks associated with storing them have also increased, necessitating robust storage solutions. This is where cold wallets come into play. Unlike their online counterparts, cold wallets offer a secure method for storing cryptocurrencies by keeping your private keys offline, away from potential hackers. Whether you're a seasoned investor or a newcomer to the crypto space, understanding the importance of cold wallets and how to choose the best cold wallet for your needs is essential in safeguarding your financial future.

Understanding Cold Wallets

Cold wallets are storage devices that are not connected to the internet, making them less vulnerable to hacking and online threats. Unlike hot wallets, which are connected to the internet and are used for everyday transactions, cold wallets are designed for long-term storage of cryptocurrencies. The technology behind cold wallets typically involves hardware or paper formats that securely hold your private keys. By keeping these keys offline, cold wallets provide an added layer of security, ensuring that your assets remain safe from cyber attacks. This distinction is crucial for anyone looking to invest in cryptocurrencies, as the safety of your investment is paramount.

Types of Cold Wallets

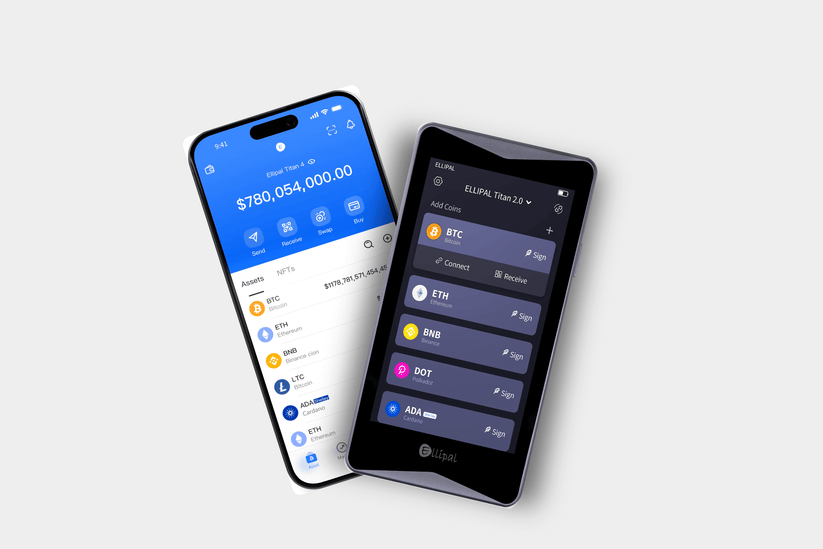

There are several types of cold wallets available for cryptocurrency storage, each with its own set of advantages and disadvantages. Hardware wallets, for instance, are physical devices that securely store your private keys and are considered one of the safest options. They are portable and user-friendly but can come with a higher upfront cost. On the other hand, paper wallets involve printing your private keys on a piece of paper, offering a completely offline solution. While they are free and highly secure against online threats, they are also more susceptible to physical damage and loss. Understanding the differences between these types can help you determine which cold wallet aligns best with your storage needs and risk tolerance.

Key Features to Look for in a Cold Wallet

When selecting a cold wallet, there are several key features to consider that enhance its effectiveness. Security measures should be at the forefront, including encryption and multi-signature support. Ease of use is another crucial factor; a wallet that is complicated to set up may deter you from using it effectively. Backup options are also essential, as they ensure you can recover your assets in case of loss or damage. Compatibility with various cryptocurrencies is another feature to look out for, as it allows you to store multiple assets without needing several different wallets. By focusing on these features, you can ensure that your chosen cold wallet meets your individual needs.

Best Practices for Using Cold Wallets

Once you've chosen a cold wallet, it's vital to use it correctly to maximize its security. Start by securely storing your private keys; consider using a safe or a safety deposit box to keep them protected. Regular backups are essential; ensure you have multiple copies of your backup stored in different locations to avoid loss. Additionally, be aware of common pitfalls, such as sharing your private keys or falling for phishing scams. Educating yourself on these threats and taking proactive measures can significantly enhance the security of your cryptocurrency investments.

Securing Your Cryptocurrency Investments

In summary, choosing the right cold wallet is a critical step in securing your cryptocurrency investments. From understanding the different types of wallets to recognizing the key features that enhance their security, being informed will empower you to make the best choice. Remember to practice safe storage habits and regularly back up your information. As the cryptocurrency landscape continues to evolve, staying updated and doing your own research will help you navigate the complexities of digital asset storage effectively. Your financial future deserves the best protection available.

تعليقات