Unlock the Secrets to Safe Crypto: Why You Can’t Afford to Skip a Cold Wallet!

In the rapidly evolving world of cryptocurrency, securing your digital assets has never been more critical. With the rise of decentralized currencies, investors are increasingly aware of the need to protect their investments from potential threats, including hacking and theft. This is where the concept of a cold wallet comes into play. A cold wallet, or cold storage, is a method of storing your cryptocurrency offline, making it significantly less vulnerable to online attacks. In stark contrast, hot wallets, which are connected to the internet, leave your assets exposed to cyber threats. As the dangers of not using a cold wallet become more apparent, it’s essential to understand its benefits and the factors to consider when purchasing one. This article aims to guide you through the ins and outs of cold wallets, empowering you to make informed decisions about securing your cryptocurrency investments.

Understanding Cold Wallets

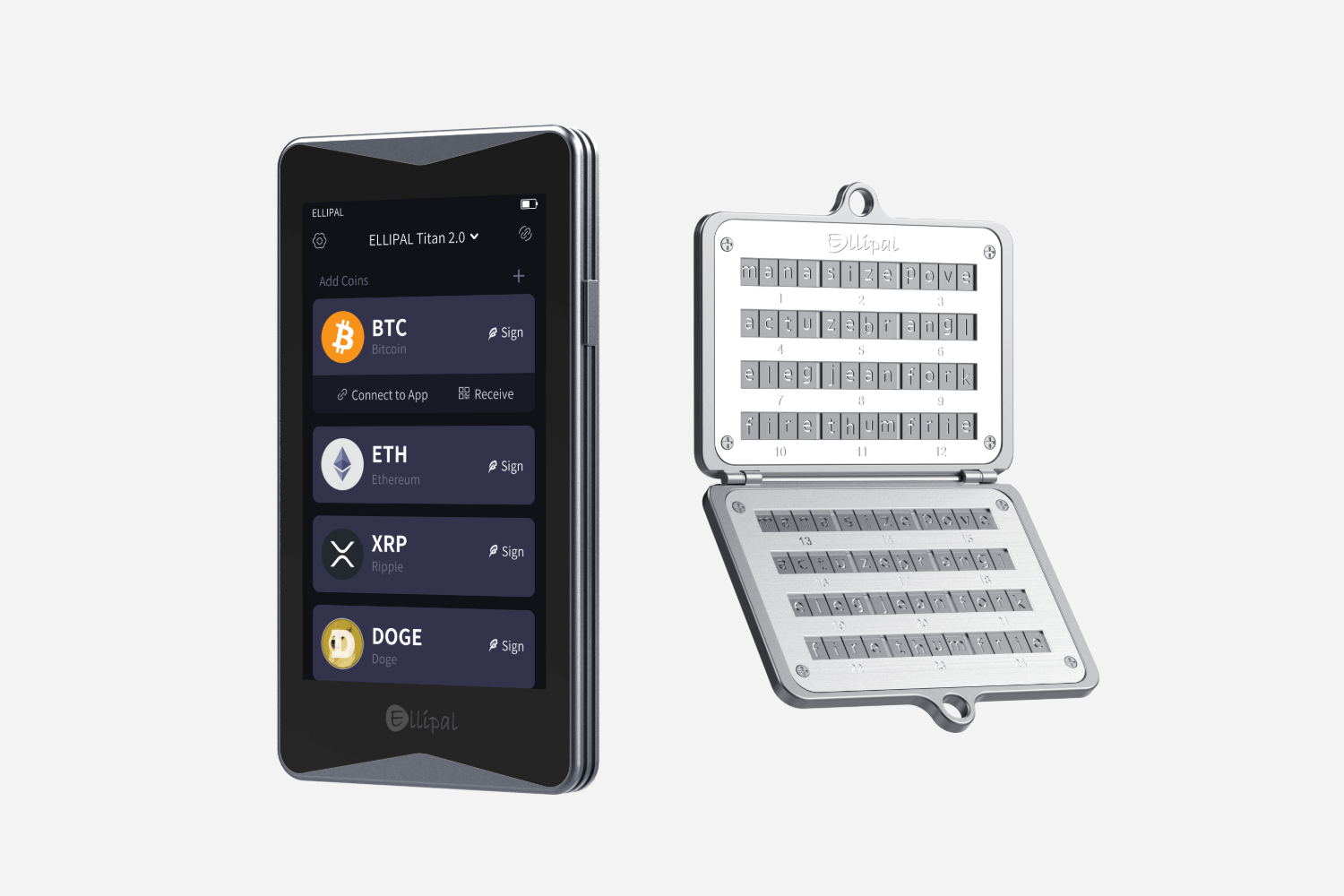

Cold wallets are a type of cryptocurrency wallet that stores your private keys offline. Unlike hot wallets, which are connected to the internet and are more susceptible to hacks, cold wallets provide a secure environment for your digital assets. The technology behind cold wallets can vary; they can be hardware devices, paper wallets, or even air-gapped computers. Each of these options serves the same purpose: to keep your cryptocurrency safe from online threats. By removing the wallet from any internet connection, the risk of unauthorized access is significantly reduced. Cold wallets are particularly beneficial for long-term investors who wish to hold their assets without frequent transactions, ensuring that their investment remains secure for the foreseeable future.

Benefits of Using a Cold Wallet

The advantages of cold wallets are numerous and compelling. Firstly, they offer enhanced security; with your assets stored offline, the chances of falling victim to hacking or phishing attacks are drastically minimized. Secondly, cold wallets give you complete control over your private keys. Unlike hot wallets, where your keys may be stored on an exchange or online platform, cold wallets allow you to manage your keys independently. This autonomy fosters a greater sense of ownership and responsibility over your assets. Lastly, many users report a sense of peace of mind when knowing their cryptocurrency is stored offline. A friend of mine, who is deeply invested in crypto, shared how transitioning to a cold wallet provided him with the security he needed to sleep soundly, free from worries about online threats.

Factors to Consider When Purchasing a Cold Wallet

When it comes to purchasing a cold wallet, several factors must be taken into account to ensure you choose the right one for your needs. First and foremost, consider the security features offered by the wallet. Look for wallets that include encryption, multi-signature support, and two-factor authentication. Ease of use is also crucial; the wallet should have a user-friendly interface that allows you to navigate it easily, especially if you are new to crypto. Compatibility with different cryptocurrencies is another important aspect; ensure that the wallet you choose can support the assets you own. Additionally, consider the backup options available. A good cold wallet should offer a secure method to back up your private keys and recovery phrases, ensuring that you can access your assets even if your wallet is lost or damaged. Thorough research is essential before making a purchase, as the right cold wallet can offer peace of mind and protect your investment.

How to Set Up Your Cold Wallet

Setting up your cold wallet may seem daunting at first, but with a step-by-step approach, you can have it running in no time. After purchasing your cold wallet, start by carefully following the manufacturer's instructions to initialize the device. This process often involves creating a secure PIN and generating recovery phrases, which are crucial for accessing your wallet in the future. Once set up, it’s time to transfer your cryptocurrency from your hot wallet to your cold wallet. To do this securely, ensure you double-check the receiving address before initiating the transfer. A common practice is to send a small amount first to verify the address is correct before transferring larger amounts. My friend often emphasizes the importance of taking your time during this process, as rushing can lead to costly mistakes. Following these steps will help you securely manage your cryptocurrency and enjoy the benefits of cold storage.

Securing Your Cryptocurrency Investments

Investing in a cold wallet for your cryptocurrency is not just a wise choice; it's a necessary step towards securing your digital assets. With the myriad of benefits that cold wallets offer—enhanced security, control over private keys, and peace of mind—there's no reason to overlook this crucial aspect of cryptocurrency management. By carefully considering the factors involved in purchasing a cold wallet and following the proper setup procedures, you can protect yourself from the risks associated with online storage. Take action today to secure your investments and enjoy the confidence that comes with knowing your assets are safe.

Comentarios