Why Is It Important to Keep Receipts?

Body

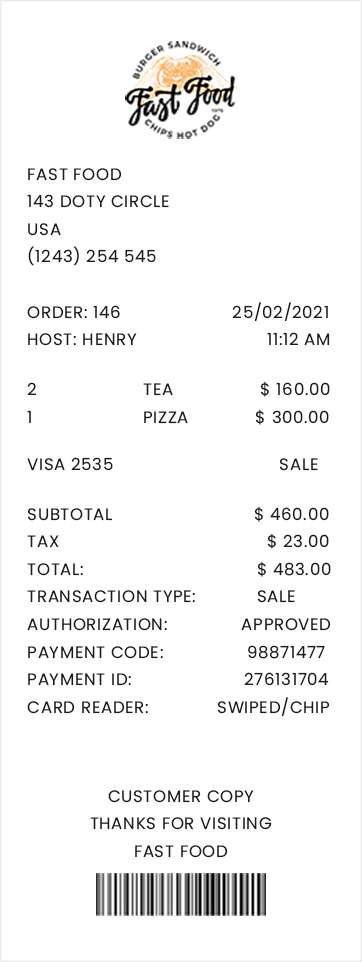

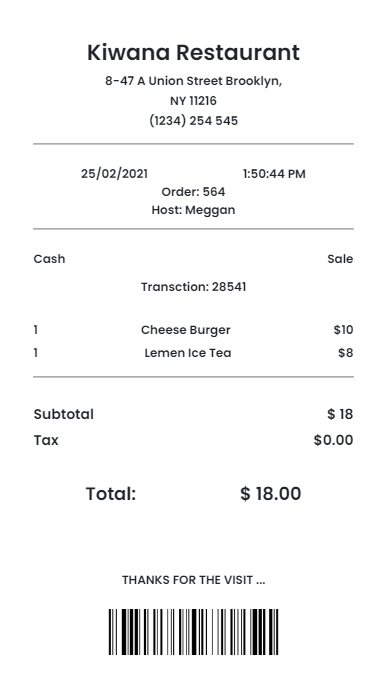

A receipt is a document confirming the receipt of a payment or other valuable item. Receipts are not only issued in business-to-consumer transactions and stock market exchanges but are also commonly received by customers after purchasing from retailers and service providers.

Why Are Receipts Important?

For businesses to have proof of some payments, Generate Receipt is required. There are a variety of receipts that small companies can Create Fake Receipt for various purposes. Here are a few examples:

- Documentation of the company's total gross receipts, including but not limited to invoices, receipt books, cash register cassettes, and deposit records (for both credit and cash sales).

- Receipt Generator for little monetary transactions (petty cash).

- Credit card receipts and statements.

- Invoices.

- Receipt Builder Tool tapes from the cash register.

- Receipts sent via electronic means, such as email.

- Purchase orders and bills for supplies. These attest to the necessity of the acquisitions and the costs involved in doing business. It would help to record who you paid, how much you paid them, any cancelled checks, and any evidence of electronic fund transfers.

How to generate the ideal receipt?

- Make the switch to digital

Those who still use carbon copy notepads instead of fake online receipt software should consider switching to the latter. Consumers widely favour electronic receipts. They're already formatted in a way that looks formal and is simple to read.

- As soon as the work is complete, please send your receipt.

Please expedite the delivery of the receipts. To keep your company's offerings, front-and-centre in the minds of your clientele. Everyone is pleased to be given a receipt immediately following the completion of a payment transaction or the delivery of a shipment of products.

- Provide specifics rather than broad statements.

Your client has a right to know how their money will be spent; your receipt is your opportunity to convey that information to them. Even though it seems perfectly reasonable, remember that the consumer is on a higher plane. Line items should be as detailed as possible rather than vague. Materials should be kept separate; individual things, like nails, wood, paint, etc., should be listed separately. Include any invoices or receipts you have to back up your claims.

- Instructions on Making Receipts

You may need to Reciept Generator for services rendered or goods sold as an individual or a business. No bills can be sent to private individuals. You should have Fake Receipt Maker for payment. When engaging with a firm as a private individual, the company would likely request a receipt as evidence of the transaction's legitimacy. A receipt is advised as proof of payment and, more generally, as proof of the agreement that has been reached for any "services" that you provide as an individual for another individual. A receipt, like an invoice, must follow a few guidelines.

Conclusion

One of the fundamental units of analysis utilized in corporate accounting is the receipt. Fake Receipts Generator serve several purposes for businesses, including as evidence of payment, justification of tax deductions, recording of expenses in the income statement, and verification of the existence of assets in the balance sheet.

Comments