Paying for Peace of Mind: Decoding Life Insurance options from Ginteja

Body

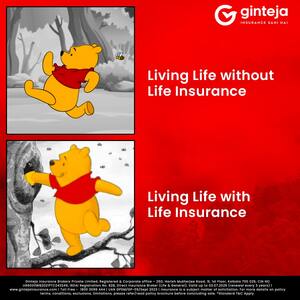

In the hustle and bustle of life, where uncertainties abound, financial security is a priceless asset. One way to achieve this security is through life insurance. And when it comes to life insurance solutions in the Indian context, one name stands out—Ginteja. In this blog, we will delve into the world of Life Insurance options from Ginteja, how it provides peace of mind, and why buying insurance online is a smart choice.

Understanding Life Insurance options from Ginteja

Life insurance is a contract between an individual and an insurance company, where the individual pays regular premiums in exchange for financial protection provided by the insurer. In the unfortunate event of the policyholder's demise during the policy term, the insurer pays out a predetermined sum assured to the nominee or beneficiaries.

Why Life Insurance option from Ginteja matters

- Financial Security: The primary purpose of life insurance is to provide financial security to your loved ones in case of your untimely demise. Life insurance policy option from Ginteja ensures that your family can maintain their lifestyle and meet financial obligations even in your absence.

- Debt Coverage: In India, many individuals have loans or mortgages. Life Insurance option from Ginteja can help cover these financial liabilities, preventing them from becoming a burden on your family.

- Legacy Planning: Beyond providing financial security, life insurance can be a tool for creating a legacy. You can leave behind a substantial sum for your heirs, ensuring their future financial stability.

- Tax Benefits: Premiums paid for life insurance policies are eligible for tax deductions under Section 80C of the Income Tax Act. This not only secures your family but also offers tax savings.

Why Buy Insurance Online from Ginteja

- Convenience: In today's fast-paced world, convenience is key. Ginteja allows you to buy insurance online, eliminating the need for lengthy paperwork and in-person visits to insurance offices. You can explore policy options, calculate premiums, and complete the purchase from the comfort of your home.

- Comparison: Buying insurance online enables you to compare different policies and their features easily. You can make an informed decision by assessing which policy best suits your needs and budget.

- Transparency: Online platforms provide transparency in terms of policy details, premiums, and benefits. You can review all aspects of the policy before making a purchase, ensuring there are no hidden surprises.

- Instant Coverage: With online insurance purchases, you can receive instant coverage once the payment is made and the policy is issued. This means immediate peace of mind for you and your family.

- Expert Assistance: While buying insurance online is convenient, you can still access expert assistance from Ginteja's team. They can answer your questions, provide guidance, and assist you through the online purchase process.

In conclusion, Life Insurance option from Ginteja is a cornerstone of financial planning in India. It offers a secure future for your loved ones, helps in debt coverage, and allows you to leave a lasting legacy. Buying insurance online with Ginteja is a smart choice, offering convenience, transparency, and instant coverage.

Investing in Life Insurance option from Ginteja is not just paying for peace of mind; it's an investment in the well-being and financial security of your family. So, take the step towards a secure future, explore your options, and embrace the peace of mind that comes with Ginteja Life Insurance.

Comments