Medicare Plan F vs. Plan G vs. Plan N

Body

Welcome to the ultimate guide on navigating the labyrinth of Medicare Plans! If you've been scratching your head over the alphabet soup of F, G, and N, fear not. We're here to demystify Medicare Plan F, Plan G, Plan N and help you find the perfect fit for your healthcare needs.

Read also: Is the Medicare Supplement Plan N Right for You?

What Exactly is Medicare?

First things first, let's unravel the mystery of Medicare itself. This program is like a superhero cape for folks aged 65 and older, swooping in to rescue them from the clutches of sky-high medical bills. And guess what? It's not just for our seasoned citizens; younger folks with disabilities can join the club too!

Medicare:

Your Nationwide Ticket to Health

Picture this: you're traveling cross-country, taking in the sights from coast to coast. With Medicare, you've got a golden ticket to healthcare no matter where your adventures take you. Yep, that's right – Medicare is your trusty sidekick, available from sea to shining sea.

Cracking the Code on Medicare Plans

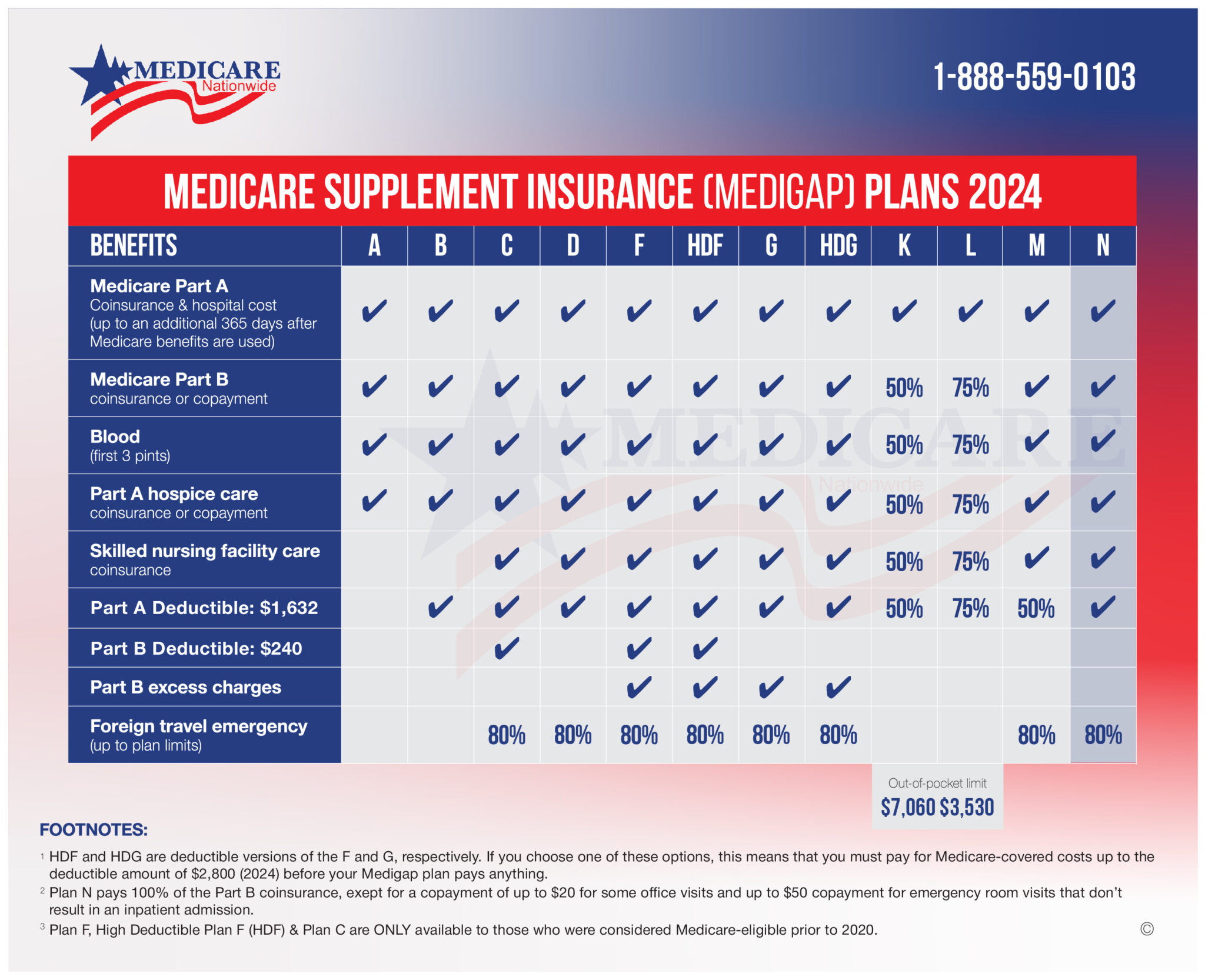

Now, let's talk about the real MVPs – Medicare Plans F, G, and N. These plans are like the Robin to Medicare's Batman, stepping in to fill in the gaps left behind by Original Medicare. They're known as Medigap plans, and boy, do they pack a punch when it comes to coverage!

Medicare Plan F:

The Superhero of Coverage

Meet Medicare Plan F – the Superman of Medigap plans. This bad boy covers almost everything under the sun, from deductibles to copayments to coinsurance. With Plan F by your side, you can strut into the doctor's office like a boss, knowing that you won't have to reach for your wallet.

Medicare Plan G:

Almost Super, Just Missing the Cape

Next up, we've got Medicare Plan G – the Batman to Plan F's Superman. Like its counterpart, Plan G is a force to be reckoned with, covering all the bases except for one: the Medicare Part B deductible. But fear not, once you've conquered that deductible, Plan G swoops in to save the day, covering the rest of your medical expenses for the year.

Medicare Plan N:

The Underdog with a Heart of Gold

Last but not least, we have Medicare Plan N – the unsung hero of the Medigap world. While it may not have all the bells and whistles of Plans F and G, Plan N still packs a punch when it comes to coverage. Sure, you'll have to chip in for some copayments here and there, but hey, that's a small price to pay for peace of mind.

Choosing Your Sidekick:

Tips for Success

Now that you've met the contenders, it's time to choose your sidekick. But fear not, dear reader – we've got some handy tips to help you make the right decision:

- Know Your Budget: Take a good, hard look at your finances and figure out what you can afford to pay each month for your Medicare coverage. Plans with more coverage often come with higher premiums, so choose wisely!

In Conclusion:

Your Journey to Medicare Mastery

Congratulations, dear reader – you've officially graduated from Medicare 101! Armed with your newfound knowledge of Medicare Plans F, G, and N, you're ready to conquer the world of healthcare with confidence. So go forth, brave soul, and may your journey be filled with health, happiness, and peace of mind.

Comments