E Money App: The Key to Effortless Money Management

Body

In the fast-paced world of today, managing finances can be a daunting task. Balancing budgets, tracking expenses, and ensuring timely bill payments require meticulous attention and time. Enter the E Money App, a revolutionary tool designed to simplify money management and make financial wellness accessible to everyone. This article delves into how the E Money App is transforming the way we handle our finances and why it might be the key to effortless money management.

The Evolution of Financial Management

Traditional methods of financial management often involved manual tracking, spreadsheets, and physical bank visits. These methods, while effective, are time-consuming and prone to human error. The advent of digital technology has brought about a paradigm shift in how we manage our money. Mobile banking apps, online budgeting tools, and automated investment platforms have made it easier than ever to keep tabs on our financial health. Among these innovations, the E Money App stands out for its comprehensive approach to financial management.

Features of the E Money App

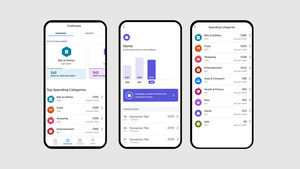

- Real-Time Expense Tracking: One of the standout features of the E Money App is its ability to track expenses in real time. Users can categorize their spending, set budgets, and receive instant notifications when they exceed their limits. This feature not only promotes disciplined spending but also provides valuable insights into spending habits.

- Automated Bill Payments: Forgetting to pay bills on time can result in late fees and a damaged credit score. The E Money App automates bill payments, ensuring that users never miss a due date. By linking bank accounts and credit cards, the app handles payments seamlessly, providing peace of mind.

- Personalized Financial Advice: The E Money App uses artificial intelligence to analyze users’ financial data and offer personalized advice. Whether it's recommending investment opportunities, suggesting savings plans, or providing tips on reducing expenses, the app acts as a financial advisor in your pocket.

- Secure Transactions: Security is a top priority for any financial tool. The E Money App employs advanced encryption and authentication methods to protect users' data and transactions. With biometric login options and regular security updates, users can trust that their financial information is safe.

- Integration with Financial Institutions: The E Money App seamlessly integrates with various banks and financial institutions, allowing users to manage multiple accounts from a single platform. This integration simplifies financial oversight and reduces the hassle of logging into different accounts.

Benefits of Using the E Money App

- Convenience: The E Money App brings all aspects of financial management under one roof. From tracking expenses to making investments, everything can be done with a few taps on a smartphone.

- Financial Awareness: By providing real-time updates and personalized insights, the app helps users become more aware of their financial habits. This awareness is the first step towards making informed financial decisions and achieving long-term financial goals.

- Time Savings: Automating tasks like bill payments and expense tracking frees up time for users to focus on other important aspects of their lives. The E Money App reduces the need for manual record-keeping, making financial management less of a chore.

- Budgeting and Planning: The app’s budgeting tools are instrumental in helping users create and stick to budgets. By setting financial goals and tracking progress, users can plan for future expenses and save for big-ticket items or emergencies.

Conclusion

In a world where financial stability is crucial, the E Money App emerges as a vital tool for effortless money management. Its comprehensive features, coupled with the convenience and security it offers, make it an indispensable companion for anyone looking to take control of their finances. Whether you are a student managing a tight budget, a professional juggling multiple expenses, or a retiree planning for the future, the E Money App can help you achieve financial wellness with ease. Embrace the future of financial management and let the E Money App guide you towards a more organized and stress-free financial life.

Comments